Samankaltaisia työpaikkoja

Oikeusapusihteeri Y9, Länsi-Uudenmaan oikeusaputoimisto (Espoo)

At Fortum we drive change where it matters. We are a European energy company providing our customers with electricity, gas, heating and cooling as well as smart solutions to improve resource efficiency. Together with our subsidiary Uniper, we are the third largest producer of CO2-free electricity in Europe. With around 20,000 professionals and activities in more than 40 countries, we have the competence and resources to grow and to drive the energy transition forward. We strive to make an impact through a culture of open leadership, curiosity and continuous improvement. Do you want to take an active role for a cleaner world? Come lead the change with us! www.fortum.com

Your role

Would you like to be a part of an international tax team with close cooperation with HR team, managing a new project related to posted workers directive and economic employer rules? We are looking for HR Tax Manager to join Fortum Corporate Tax in Espoo. Corporate Tax Team is responsible for advising and supporting business operations in different tax matters including CIT, VAT, property, production and other tax issues. You will be responsible for hands-on tax management in HR tax issues for all Fortum group companies. You have a possibility to establish, implement and lead a new process relating to EU posted workers directive and economic employer legislations. Additionally, you will be advising in standalone various cases worldwide as well as training business operations in practical tax matters. Your work will include e.g. participation in different projects and handling discussions with external and internal stakeholders. Depending on your capabilities and interests you will get also other corporate tax team tasks.

The position is located in Espoo, Finland and reporting to Head of Income Tax Planning and HR Taxes / Minna Wallin based in Finland.

We offer you

This is the start of your meaningful career journey at Fortum. We actively encourage development activities across the company with open leadership as our guiding principle. This position gives you an excellent insight into the tax and HR processes in Fortum group. You will have the opportunity to develop your expertise and gain experience within Fortum tax team in the challenging and versatile international environment. As a manager at Fortum, you will get an opportunity to develop your professional skills in tax matters from a group point of view. You will gain a view into the international development of tax management and rules in a dynamic and growing international business. The team you work in strives to be the forerunner in its industry. You get to work with positive and team-oriented colleagues.

Your qualifications

We believe that suitable candidates have university degree in Law, Economics or other relevant field with 2-4 years of experience. Knowledge of individual taxation is definitely a merit, as are project management skills. You have very good written and spoken Finnish and English skills and are proficient in MS Office. We expect you to be a hands-on person with a positive can-do attitude. You are capable of working independently and making decisions, and you have good co-operation skills even during stressful moments.

Interested?

Please send your online application and CV via our online recruitment tool by November 2nd 2021 at the latest. For more information on us and the position please visit our website www.fortum.com or contact Minna Wallin, Head of Income Tax Planning and HR Taxes on 27th October between 11.00 and 13.00 EET, tel. +358 44 5777 021 or [email protected]

To be selected for the position, the applicant must go through background clearance and a health examination including drug testing.

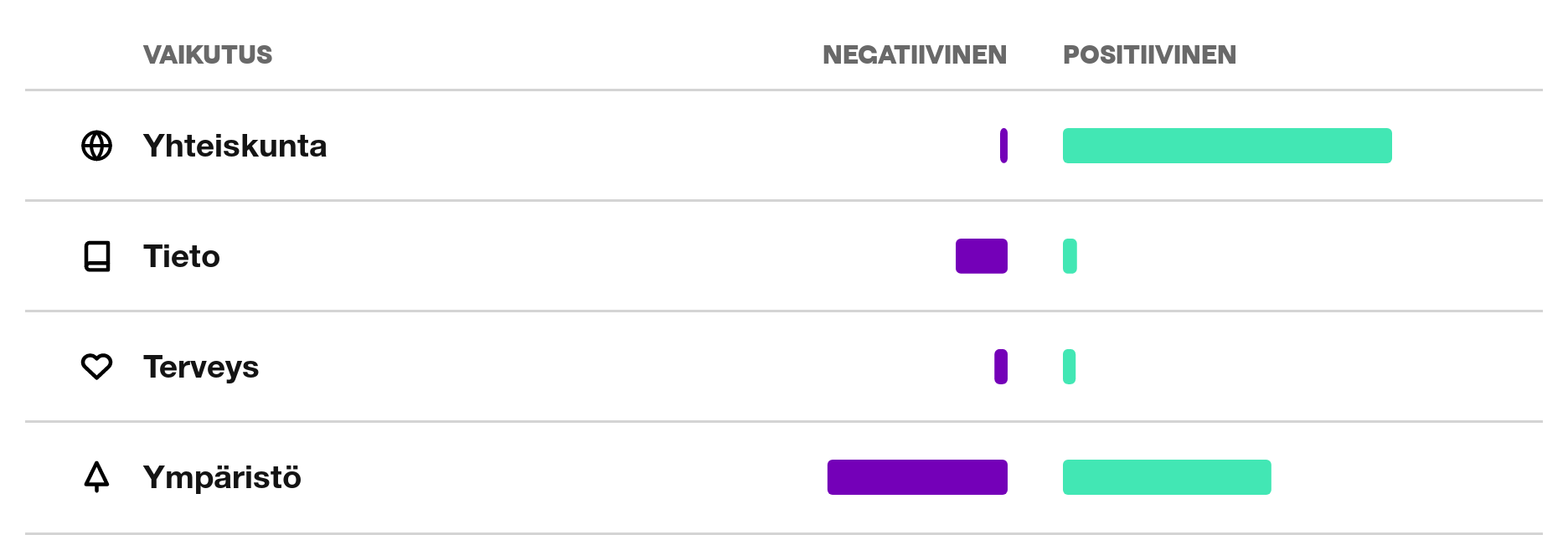

Fortum synnyttää merkittävimmät negatiiviset vaikutuksensa tai käyttää resursseja liittyen biodiversiteettiin ja niukkaan osaamispääomaan, luokissa Ympäristö ja Tieto.

Mikä vaikuttavuusprofiili?

Nettovaikutusprofiilin on mallintanut Upright Project. Profiili perustuu tieteellisen tutkimuksen ymmärrykseen erilaisten tuotteiden ja palveluiden vaikutuksista. Profiili kertoo mihin asioihin sinäkin olet mukana vaikuttamassa tämän työpaikan kautta. Lisätietoa Uprightista löydät täältä.